Trials & Tribulations: Preparing for the Transfer of Wealth

We are about to experience the most significant wealth transfer in our lifetime. According to Cerulli Associates, over 45 million U.S. households will transfer $68 trillion in wealth over the next 25 years. The redistribution of wealth presents excellent opportunities for wealth firms to establish deeper relationships with new customers while helping retain and grow their book of business. The shifts across wealth will be lasting and transform not only the way financial services firms run operationally but meet their larger goal of enhancing client experiences, building more trusting client relationships, and encouraging loyalty from financial advisors.

Challenge Ahead & Compliance

Many firms and advisors are struggling to retain the family wealth portfolio and their business. As relationships change, most advisors do not have the information or data to understand their clients’ households and areas of influence to remain competitive. The rise in FinTech and lower-cost alternatives have disrupted the game, while further segmenting the market. Regulation and compliance also remains a hot topic, which the SEC mandates as part of Regulation Best Interest (compliance by June 20, 2020).

In summary, Reg BI requires:

- Disclosure – Brokers must disclose material facts related to customer relationships, product recommendations, and service advice provided.

- Care Obligation – Due diligence provided for recommendations to a customer, including potential risks, rewards, and costs associated.

- Conflict of Interest – Broker must establish, maintain, and enforce written policies and procedures to disclose or eliminate any conflicts of interest.

- Compliance – An enhancement from the original regulation, brokers must now maintain and enforce established policies and procedures with Regulation BI.

For additional reference, FINRA provides more details on Regulation Best Interest (Reg BI).

The wealth industry has reached the end of the line, with digital a key to transforming. Gone are the days of portfolio management, investment advice, and a heritage brand. The evolution of financial planning requires more holistic offerings through digital.

Private banks, like many across the industry, are missing a seamless, integrated client journey that addresses critical customer pain points with digital capabilities. Firms spend too much effort on standalone deliverables like developing the next best portfolio planning app and too little, enhancing the core systems to link data into meaningful information. The challenge remains to construct a complete end-to-end digital experience tailored to your clients’ needs and lifecycle (including households).

Solving for the Experience

Wealth & Asset Management firms need to act in the best interests of the customer. Uniting client engagement with the front office (Wealth Advisor), Mid Office (Support areas), back-office (Core Banking), and External Parties.

Client Engagement: Digital channels (web/mobile/social) remain the “holy grail,” allowing financial advisors to engage younger demographics and streamline operating costs through self-service and automation. Establishing client community portals synced with customer engagement platforms (i.e., CRM, Call Center) improve guided conversations and support.

Front Office: Enhancing front office processes to manage your advisory practice better and ensure compliance standards. Tailoring technology to align the advisor’s book of business, which provides an engagement layer across the client’s lifecycle to drive productivity and insights.

Mid Office: Enabling processes to support risk management collaboratively across the organization remains critical. Simplifying workflows help establish standards and audits while providing visibility to administrative support to customer-facing teams.

Back Office: Infusing core banking and enterprise functions across product, service, and other support areas help provide visibility to both front and middle office teams. Aligning product operations through a product/portfolio catalog helps to identify configurations and offerings for groups supporting fulfillment and servicing. The integration of core banking functions like cash management, payments, finances, and investments provide more in-depth insights and operational efficiencies.

External Teams/Partners: Extending relationships with the broader wealth management ecosystem help establish relevance and efficiency. By staying connected with custodians, brokers/transfers agents, account aggregators, and clearinghouses provide a single point of access to collect useful customer insights and needs from external party information and data.

Addressing the transfer of wealth and ability to personalize next-gen relationships

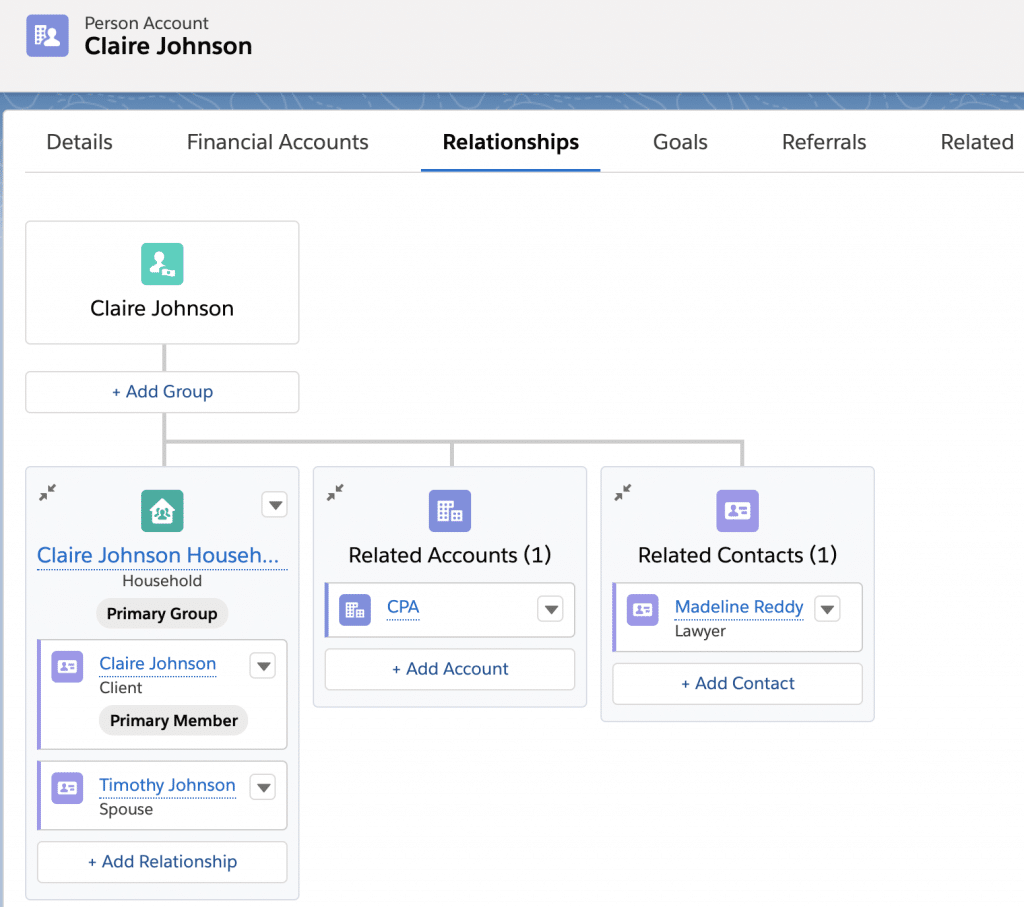

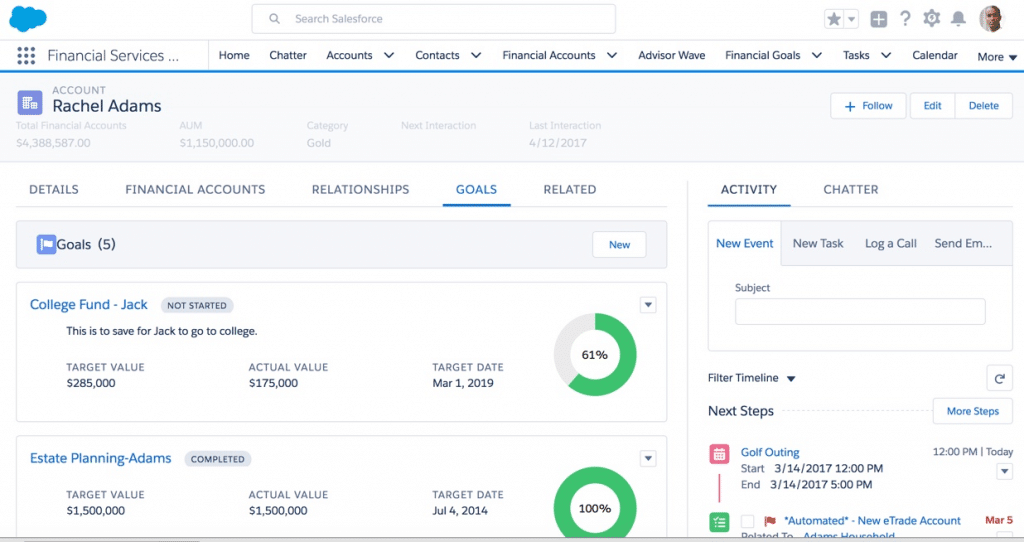

Advisors need support to deliver tailored client advice across their book of business. The lack of proper technology and redundant systems further impedes the Advisor’s ability to offer a superior client experience. Creating client and household profiles allows you to sync relevant information across financial products, goals, and interactions. Connecting households, trusts, and business groups transform a single relationship into opportunities for client growth. This information helps to identify critical relationships (some that may hold later relevance). Providing a holistic picture of your clients’ needs, as well as opportunities to increase Assets Under Management (AUM) with insights into the wallet share of a household and held-away assets.

Insights and knowledge to advise based on needs assessment

Enhancing client insights through sentiment analysis, competitor mentions, and overall engagement scoring help to improve broker interaction and productivity. Enhancing customer support based on context and history provides timely and relevant answers for brokers and support teams who service and onboard customers. It is also essential to identify the resources colleagues need to easily find – automatic suggestions for relevant expertise, groups, and content based on the client’s interests, needs, and behavior from activities. These events trigger interaction, alerts, and context for brokers and across support teams. For example, triggering a reminder to capture a digital signature for the Form CRS to track and log interactions by the client.

“Artificial intelligence is the modern-day gold rush of the financial services industry, and those that get in early will reap the rewards of this next wave of innovation.”

– Rohit Mahna, SVP & GM, Salesforce Financial Services

Information and intelligence for advisors not only increases productivity but enables proactive response and real-time advice to clients. Transforming data into information helps grow Assets Under Management (AUM) while expanding relationships and clients’ lifecycle needs (i.e., College Fund). Advisors having the tools and insights empowers them to focus on the right investments and growth strategies while helping clients plan for other life events and transition points (e.g., childbirth). Having these relevant client insights can help predict future outcomes, proactively recommend the next best actions, and automate manual tasks around the transfer of wealth and more for the advisor.

Simplify the process for compliance and tracking

Standardized processes and automated workflows provide structure for collecting information and distributing across the enterprise. Through the creation of colleague (employee) profiles/roles and targeted process flows (to appropriate teams with alerts), information becomes easily accessible and auditable. Streamlining collaboration through one toolset allows for complete visibility into all interactions. Reporting becomes more engaging and interactive across processes, customer interactions, product advice, and purchase. These processes also help with regulatory compliance (i.e., RegBI) by streamlining broker, investment advisors, and associated parties to act in the best interest of the customer.

Let us help you bring personalized, proactive engagement and advice. Create relevance with your clients to establish high-value relationships and growth opportunities. Xede provides tailored solutions to address:

- Advisor Productivity & Regulatory Compliance – productivity tools to save time and enhance customer experience, including sharing investment guidance.

- Client / Advisor Portals – online portals to share portfolio progress and support self-servicing.

- Financial Planning / Intelligence – tools and resources to support financial planning interactions with clients related to life goals, life events, market insights, analytics.

- Marketing / Insights – detailed insights to convert high value leads into top customers and support inter-generational wealth transfer.

About the Author

Scott Hamerink, VP of Financial Services

Scott brings more than 18 years of experience leading enterprise customer engagement and digital initiatives, primarily within Financial Services. His executive experience and insights provides in-depth perspectives for industry-relevant solutions across banking, insurance & healthcare.

- The Value of Marketing Cloud Realized for Financial Services - August 14, 2020

- Are Credit Unions Transforming Member Experience? - August 10, 2020

- One Preference Center to Rule Them All: Xelerating SFMC - June 12, 2020

Connect with Xede today to start growing your business faster, smarter and stronger.