Transforming From Traditional Lending

From Crisis to Digital Creation

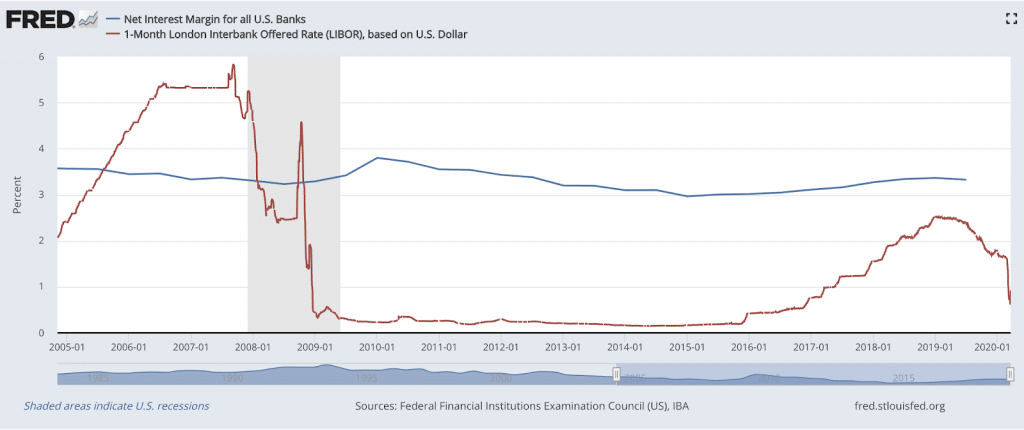

The start of 2020 has become a cold reality for banking — specifically with the deterioration in net interest margin (NIM). Why? Net interest margin is a crucial indicator of a bank’s profitability and growth. It shows how much loan interest the bank earns compared to the interest cost for deposits. Banks in the United States use LIBOR to set the borrowing rate for lending. LIBOR is the interest rate that one bank charges another for a loan. Does the current crisis impact transition plans and timing to replace LIBOR? For more details on LIBOR, check out our previous article, Preparing for LIBOR – Strategies to Engage Your Customers Today.

As we compare NIM for all U.S. Banks to LIBOR, an eerie memory of 2008’s financial crisis starts to play out. Or does it? It is essential to recall the tightening of lending standards accounted for part of the negative loan growth during the last recession. We are not going to compare the economics of the financial crisis recession and the coronavirus outbreak. Not many companies in the financial services sector are immune to the impact of the coronavirus. On March 30, the Federal Reserve announced it would loosen bank regulations to support lending through the COVID-19 pandemic. These modifications allow banks to assume more risk in lending to individuals and businesses. These changes, coupled with historically low-interest rates, will not only encourage lending but accelerate digital enablement. The critical focus area being how lenders will leverage technology, disruption, and digital enablement to optimize front, middle, and back-office processes.

So what does this mean? Digital investment is a need for survival.

Now more than ever, customers expect and demand immediacy for banking interactions, yet traditional lending is beyond antiquated. Also, fintech shows no mercy. Digital powers like Square, who received conditional ILC (Industrial Loan Company) approval on March 18, 2020, drive ease-of-use, fast, and effortless lending to the masses. Banks, credit unions, and other traditional lenders find themselves not only unprepared but soon to be displaced. However, there is hope for conventional lending as digital enablement of process optimization drives economies of scale, especially around operational areas (i.e., credit decisions, loan origination). Highlighted below are several examples of how our current economic situation is transforming traditional lending practices:

Now more than ever, customers expect and demand immediacy for banking interactions, yet traditional lending is beyond antiquated. Also, fintech shows no mercy. Digital powers like Square, who received conditional ILC (Industrial Loan Company) approval on March 18, 2020, drive ease-of-use, fast, and effortless lending to the masses. Banks, credit unions, and other traditional lenders find themselves not only unprepared but soon to be displaced. However, there is hope for conventional lending as digital enablement of process optimization drives economies of scale, especially around operational areas (i.e., credit decisions, loan origination). Highlighted below are several examples of how our current economic situation is transforming traditional lending practices:

Commercial Loan Originations

Big and small companies will be looking for options to increase their financial footing. Home Depot raised it’s short-term borrowing of commercial paper to $6 billion and obtained a new $3.5 billion credit facility. We already see expansion across operations in commercial banking. Hancock Whitney (HWC), a $30 billion-asset bank in the Southern U.S, is looking at expanding its commercial focus. They are planning a significant investment in a financial center and loan production office (over 6,000 sq ft), focused on serving business and commercial clients throughout the region. Streamlining the “lead to loan” process requires aligning people, process, and technology for digital enablement. As traditional lenders seek to establish a customer engagement layer that complements core banking platforms, while linking front, middle, and back-office operations. Digital acceleration is here and specifically in the areas supporting servicing spikes and onboarding efficiencies (across loans, capital/equipment, real-estate), including automating existing processes to generate key client-facing documents, loan management, and collateral asset tracking.

Small Business Lending

Under the “Paycheck Protection Program,” the Small Business Administration is lending $349 billion to businesses. These loans are provided through banks, credit unions, and other lenders partnered with the SBA. Sounds great, right? Not exactly. Many lending institutions are ill-prepared for the onslaught of loan applications. New systems to support customer notifications, engagement, and onboarding will be necessary. Many lenders will need to quickly ramp up marketing outreach along with landing pages for information and business applications. Customer engagement across loan origination and onboarding has amplified with the FED’s actions to reduce rates. This action has resulted in institutions to require support across customer communications and core customer engagement platforms (e.g., CRM) while streamlining back-office systems and processes (i.e., Loan Origination Systems and lending processes).

Simplifying Mortgage Lending

Strains to the mortgage ecosystem have already been felt across the country. Mortgage lenders are struggling to prepare for a tsunami of mortgage delinquencies and distressed homeowners. Consumers are already looking for reprieve. And firms are actively seeking the ability to communicate to customers quickly and offer assistance (i.e., Mortgage/Financing relief, waived fees, extended service hours, and self-servicing). Operational effectiveness will be critical to enhancing improvements to FCR (First-call resolution) and AHT (Average handling time) to support increased calls and surging demands. LoanCare, serving $360 billion in mortgages, has received over 21,000 calls in the past two weeks.

Streamlining Digital Consumer Lending

Consumer lending disruption by fintech continues to focus on speed and convenience. Digital remains the equalizer for incumbent banks and lenders to compete in a digital first environment. Integrating the customer journey from “lead to loan” while simplifying applications, approvals, and transparency is key to transform traditional consumer lending to digital.

Asset Financing & Leasing

Monitoring the entire lease or loan from selling to origination provides transparency for customers and your employees. Having the right information on the statuses of leases or loans offers easy access and collaboration and document management (e.g., lease agreements or guarantees). Having the entire lease or financial relationship, including asset management, document capture, and credit/underwriting in a digital environment drives greater productivity and efficiency. Digital enablement and automation results in lower operating costs, higher customer experience/engagement, and more deals.

Digital Enablement

Digital strategies are not just relevant but necessary for survival now. Harnessing the power to improve operational control, reduce costs, build new revenue streams, mitigate risk, and compliance is possible. Taking the first step is crucial to unifying solutions to drive value across lending, including:

- Create a unified view of all assets to enable deal optimization

- Extend servicing through self-service and online guidance/support

- Gain full relationships across lease/loan participants and interactions

- Enhance and automate operational workflow and credit/underwriting

- Connect customers, third-parties across digital channels

- Securely maintain compliance and audit tracking requirements

Email us to learn more at financialservices@xede.com.

***

Scott Hamerink leads industry strategy and thought leadership efforts as VP of Financial Services at the Xede Consulting Group. He brings over 18 years of industry experience leading enterprise customer engagement and digital initiatives across banking, insurance, and healthcare. Scott is a frequent speaker at national forums on topics ranging from customer experience to digital transformation. He received his MBA from The University of Michigan, Ross School of Business, BS: International Business and MS in Information Systems from The University of Detroit.

- The Value of Marketing Cloud Realized for Financial Services - August 14, 2020

- Are Credit Unions Transforming Member Experience? - August 10, 2020

- One Preference Center to Rule Them All: Xelerating SFMC - June 12, 2020

Connect with Xede today to start growing your business faster, smarter and stronger.