Why Financial Service Institutions Continue to Struggle With Digital Transformations

Are you exhausted with the prophecies and buzz around “digital transformation”? It seems like everywhere you look, more information, products/solutions, and services exist; however, few transformations focus on the fundamentals of your business model, addressing customer needs and solving “pain points.” When we talk about customer experience, we think about service and support. While yes, these are part of the equation, customers expect much more than high-quality service. Strategies to encourage customers to spend more through “delightful experiences” may sound good, but it often insults customers – treating them like objects of desire and transactional relationships.

Most organizations pursuing digital programs experience challenges due to the speed of change, duration, and fragmented ownership across the enterprise.

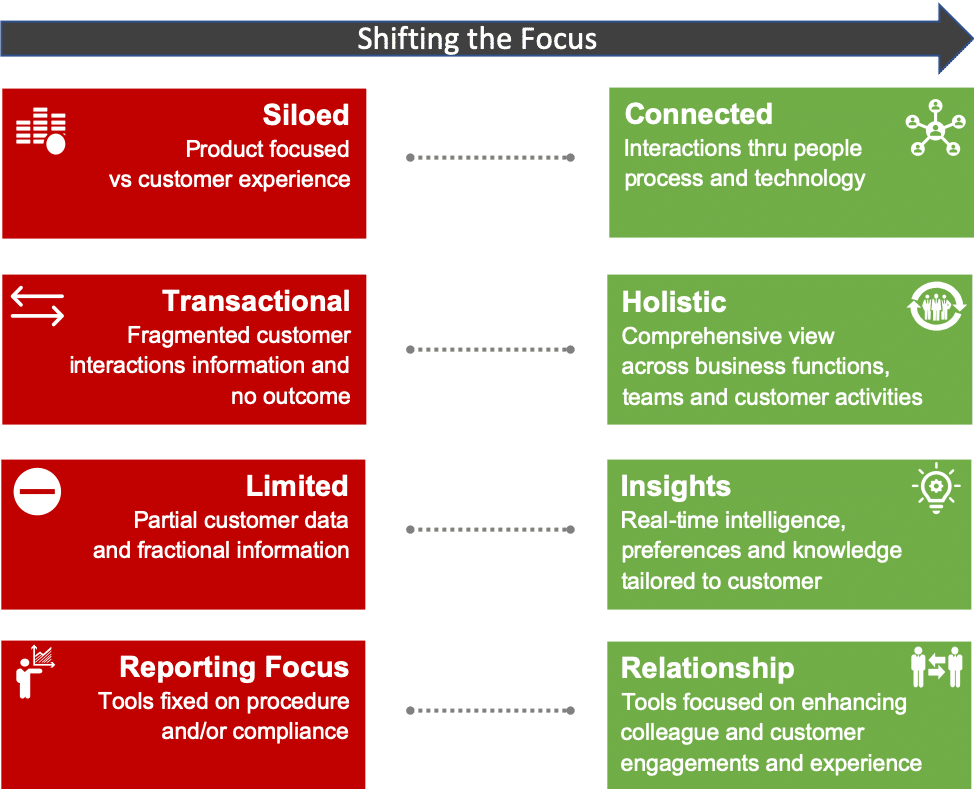

Many firms have multiple lines of business, each driving a segmented strategy disjointed from the enterprise. While not intentional, it creates complexity across intended audiences and establishing a unified vision and roadmaps to get there. Also, the struggle for organizational alignment and commitment to securing cross-functional time and resources (front and back office) further fragments the customer experience. For example, many firms focus on siloed integration (one-to-one) with the core (i.e., payments, lending, policy/claims) rather than relationships across (one-to-many). Also, most companies focus on the channel rather than customer interaction points and intent. Finally, firms don’t set aside long term budgets and lose by focusing on annual project funding with short-term prioritization.

Solving for Customer Engagement

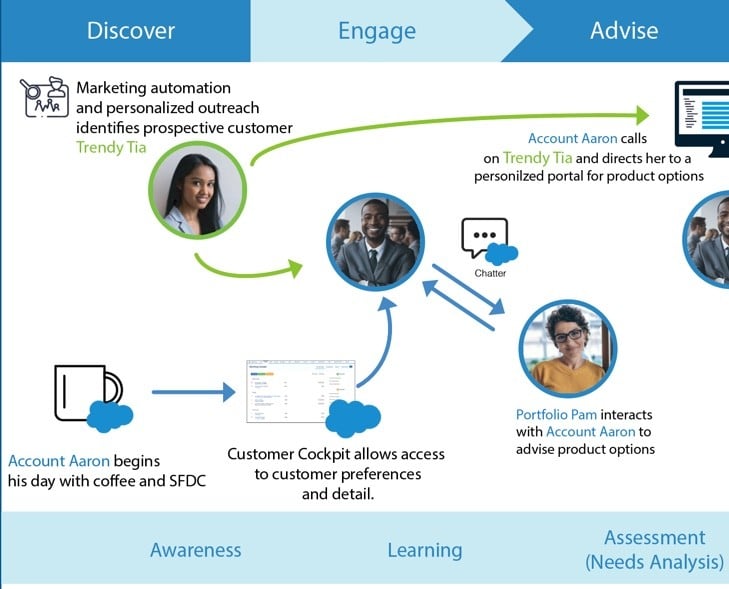

Improving the customer experience hinges on knowing your customers – their interactions, transactions, behaviors, and intent. As leaders of the industry, we often say we have the data but is it meaningful? Harnessing the elements of customer data across their lifecycles and presenting personalized relevance and guidance proactively remains the key. This requires continuous engagement with them to demonstrate your focus on them (not your business needs).

1. Evolving with a Growth Mindset

The traditional model of technology teams delivering to requirements is “dead.” These teams need to develop into solution providers inspired by vision and roadmaps. The approach requires new talent and discipline around experience design, agile practice, and change management metrics focused around:

- Defining Value Drivers & Success Metrics based on inside and outside industry practices

- Establishing Business Capability Frameworks across the enterprise (including core operations, security/risk and compliance)

- Focusing on User Experience Design & Adoption (including change management scorecards)

- Delivering results through Agile Product Delivery practice (not just principle) for “quick wins” and iterative releases

- Embedding Data and Business Intelligence to measure and monetize strategies

As organizations mature to leverage cross-functional teams, focus becomes a unified customer viewpoint. Fragmented transactions, like back-office customer onboarding, become engaging dialogue to personalize and self-service customers in real-time. Data intelligence becomes collective storytelling focused on information tailored to that customer’s life cycle needs. Organizational leadership becomes intimate with live customer feedback that guides and drives strategy and focus.

2. Align Business Objectives to Customer Outcomes

Customer Relationship Management (CRM) remains an ambiguous term that often forces us to a solution. One of the first things I did when leading an enterprise transformation was to rebrand “CRM.” When you unpack the true meaning of CRM, it’s primary focus relates to continuous relationship management. Your business goals should be enabling customer success. Many companies pride themselves on being “relationship-oriented” – sure it sounds great, but are you relevant? If your customer is looking for a more convenient way to interact, are you aware or even present?

It’s simple, helping your customers reach their short- and long-term goals are table stakes. By providing a holistic view across business services/functions, employees/teams, and customer activities, you can quickly surface relevant information to make a decision. For example, in financial services, enhancing customer onboarding remains a key business objective. Understanding the customer’s desire for flexibility to call (voice) and have self-servicing options/alerts available and personalized to their interactions would help drive outcomes. For example, you call into a call center and get transferred a couple of times or placed on hold for an extended period to repeat the reason for your call. You can relate to the outcome here.

3. The Customer Journey defines the Transformation

We often talk about “People, Process, Technology,” it’s a commonplace, right? That said, we lose most of the time because we jump to the tech solution. It’s easy; no one wants to relate to people – we know what we want and process – well, it’s boring and not the actual problem as an “app exists” for that or the tech solution “easy button.” Starting with a customer journey map provides an outside-in perspective. Through mapping customer and employee interactions, “pain points” are identified along with opportunities.

Here are some of the critical highlights of journeys:

- Tells the experience story starting with the initial contact, through the engagement lifecycle and into long-term relationships.

- Identifies and links events before, during, and after all, interactions with your product or service.

- It guides the move from a transactional approach to an engaged and empowered customer relationship built on respect and trust.

- Distinguishes significant customer interactions with the organization, specifically the employees that support (both front and back office) by improving user experience through each touchpoint.

While journey maps aren’t the only way to improve customer experience, they are an excellent starting and reference point for mapping your organization to the customers’ perspective.

Closing the Gap

The rules have changed around digital value creation. Unpacking complexity and focusing on the basics for how your employees and customers interact and transact is easy. The hard part is placing value before profit. Capgemini reported that 75 percent of companies consider themselves to be customer-centric, but only 30 percent of customers agree. This unfortunate gap exists because companies engage with customers on a superficial level and view them as replaceable. Well, guess who is genuinely replaceable.

- The Value of Marketing Cloud Realized for Financial Services - August 14, 2020

- Are Credit Unions Transforming Member Experience? - August 10, 2020

- One Preference Center to Rule Them All: Xelerating SFMC - June 12, 2020

Connect with Xede today to start growing your business faster, smarter and stronger.